Compensation

Compensation

Compensation is the total reward given to employees in return for their services. It includes both direct (salary, wages) and indirect (benefits, allowances) components.

Methods of Pay

Types of Allowances

Allowances are extra payments provided over and above basic salary to meet specific needs

Pay Structure

A Pay Structure is the framework that defines different components of an

employee’s salary. It includes fixed pay, variable pay, benefits, and

deductions.

Key Components of Pay Structure

Gross Pay

Gross Pay = Basic Pay + DA + HRA + All Allowances (before deductions)

👉 It is the total earnings before tax and other deductions.

Deductions

These are subtracted from gross pay:

Take-Home Pay (Net Pay)

Take-Home Pay = Gross Pay – Deductions

👉 This is the actual amount received in the employee’s bank account.

Summary Table

Incentive Schemes

Incentive schemes are additional payments or rewards given to employees to

motivate higher performance, productivity, or achievement of specific goals

beyond regular pay.

Purpose

- Encourage better performance

- Increase productivity

- Reward skill and effort

- Align employee goals with company objectives

Methods of Payment

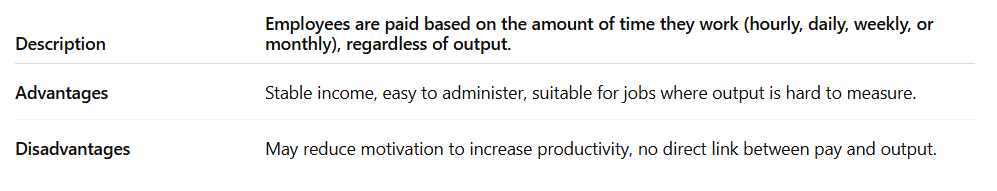

1. Time Rate Method

2. Piece Rate Method

Summary Table

Fringe Benefits & Other Allowances

Fringe benefits are non-monetary rewards or indirect benefits provided

to employees in addition to their basic salary and allowances. These

improve employee welfare and job satisfaction. Examples:

Health insurance, Retirement benefits (Provident Fund, Pension), Leave

encashment, Employee stock options, Company car or accommodation

Other Allowances

These are additional cash payments given to employees for specific purposes or to compensate for particular expenses or conditions.

Summary Table

Regulatory Compliance

Regulatory compliance refers to the process by which organizations

ensure they follow laws, regulations, guidelines, and specifications

relevant to their business operations, especially in labor and wage

management. It ensures legal adherence, protects employee rights, and

promotes fair workplace practices.

Wage and Pay Commissions

Wage Commissions are appointed by the government to review and

recommend fair wages for different industries or sectors. Their role

is to study the wage structure, cost of living, productivity, and

suggest minimum wage levels to ensure fair compensation.

Examples include the First National Wage Commission (1946) and

subsequent commissions in India.

Overview of Minimum Wages Act, 1948

Purpose: To fix and enforce minimum wages for workers in

various industries to prevent exploitation.

Key Features

- Sets minimum wage rates based on skill level, industry, and region.

- Employers must pay no less than the prescribed minimum wage.

- Covers both scheduled and unscheduled employments.

- Provides legal protection to workers against unfair wages.

Overview of Equal Remuneration Act, 1976

Purpose: To ensure equal pay for men and women for the same

work or work of similar nature.

Key Features

- Prohibits discrimination in wages based on gender.

- Mandates equal pay for equal work without discrimination.

- Encourages gender equality in employment terms and conditions.

- Applies to all establishments employing 10 or more workers.

Profit Sharing Options

Profit sharing is a method where employees receive a share of the

company’s profits, aligning their interests with the organization’s

success.