Unit 1: Derivatives Market

Introduction to Derivatives Market

The derivatives market is a financial market where people trade instruments (called derivatives) whose value depends on or is derived from the value of other underlying assets such as stocks, bonds, commodities, interest rates, or currencies.

A derivative is a financial contract between two or more parties whose value is based on an underlying asset. It is called a derivative because it "derives" its price from the underlying asset.

Examples of underlying assets:

- Stocks

- Bonds

- Commodities (like gold, oil)

- Currencies

- Market indexes

Evolution of Derivatives Market

Features of Derivatives

1. Forward Contracts

A private agreement between two parties to buy/sell an asset at a future date for a fixed price.

Key Points

- Not traded on exchange (Over-the-counter - OTC).

- Customized as per party needs.

- Higher risk of default (counterparty risk).

Example: A wheat farmer agrees to sell 100 tons of wheat to a buyer at ₹2,000 per ton after 3 months.

2. Futures Contracts

A standardized contract to buy/sell a particular asset at a specified price on a specified future date, traded on a formal exchange.

Key Points

- Traded on organized exchanges like NSE, BSE.

- Regulated by SEBI in India.

- Daily settlement (Mark-to-Market).

- Lower counterparty risk due to clearinghouse guarantee.

Example: A trader buys a Nifty Futures contract predicting that the index will rise.

3. Options Contracts

A contract that gives the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price before or on a specific date.

Types of Options

- Call Option: Right to buy.

- Put Option: Right to sell.

Example: If you buy a call option on Infosys at ₹1,500 with expiry in 1 month, you can buy Infosys at ₹1,500 even if its market price goes up to ₹1,700.

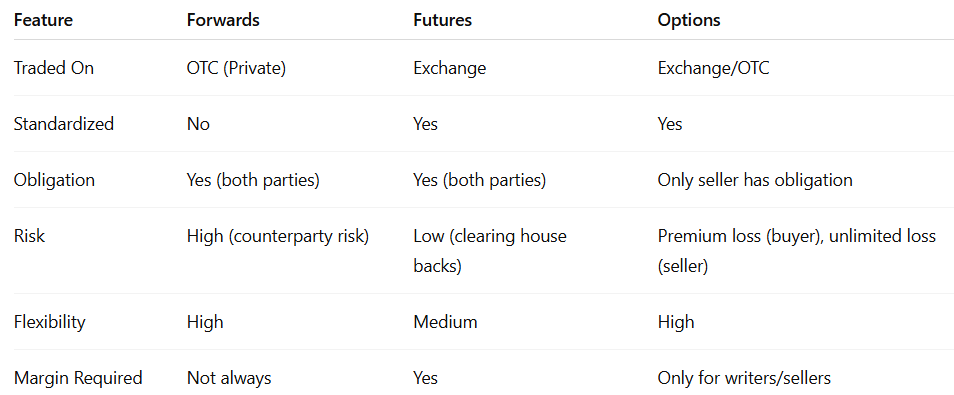

Comparison of Forward vs Futures vs Options

Forward Market Transactions

Forward market transactions refer to agreements where the buying and selling of an asset are decided today, but the actual delivery and payment are made on a future date at a predetermined price.

Key Features

- Traded over-the-counter (OTC) – not on a formal exchange.

- Customized terms (quantity, quality, delivery date, price).

- Used mostly by businesses and financial institutions to manage future price risk.

Example: A textile exporter agrees today to sell $10,000 after 3 months at ₹83 per dollar, regardless of the future exchange rate.

Forward Contracts

A forward contract is a private agreement between two parties to buy or sell an asset at a specific future date for a price agreed upon today.

Characteristics

Forward Market in India

In India, the forward market mainly operates in the currency and commodity segments.

Regulatory Framework

Forward contracts in India are mainly used for

- Currency risk management (forex forwards)

- Commodities hedging (agri-commodities, metals)

Example: An Indian importer books a forward contract to buy US dollars at a fixed rate to avoid losses if the INR depreciates.

Hedging with Forwards

Hedging is a strategy used to reduce or eliminate the risk of price fluctuations in the market.

How Forwards Help in Hedging:

Example: If an exporter expects to receive $50,000 in 3 months, and is afraid that the dollar may weaken, he enters a forward contract to sell USD at today’s agreed rate to avoid losses.

Advantages of Forward Contracts for Hedging

- Eliminates uncertainty of future prices.

- Flexible and customizable terms.

- Useful for long-term contracts and planning.