Unit 3: Foreign Exchange Transactions

Foreign Exchange Transactions

Foreign exchange transactions involve buying or selling foreign currencies for local currency (like INR) between banks, businesses, or individuals.

Types of Forex Transactions

Example: An importer purchases USD from a bank by paying rupees. , An exporter sells USD to a bank to receive rupees.

Exchange Quotations

An exchange quotation refers to how one currency is priced in terms of another.

Types of Exchange Quotations

In India: Direct Quotation is commonly used (e.g., 1 USD = ₹82).

Formula

Two-Way Quotation (Bid-Ask Spread)

Banks quote two exchange rates:

- Bid Rate: Rate at which the bank buys foreign currency.

- Ask (Offer) Rate: Rate at which the bank sells foreign currency.

Example: 1 USD = ₹81.80 / ₹82.20 , ₹81.80 → Bank buys USD from you (Bid). , ₹82.20 → Bank sells USD to you (Ask).

Why Two-Way Quotes?

- It allows banks to earn profit from the spread (Ask – Bid).

- Ensures liquidity and efficiency in forex markets.

Summary Table

Spot and Forward Transactions

Example:

- Spot: An importer buys USD on 24 July 2025 for immediate payment.

- Forward: An importer agrees today (24 July) to buy USD on 24 August 2025.

Forward Margin

Forward Margin is the difference between the forward rate and the spot rate.

Formula

Types

Purpose of Forward Margin:

- To hedge foreign exchange risk.

- Helps importers/exporters lock in rates and avoid losses from rate fluctuations.

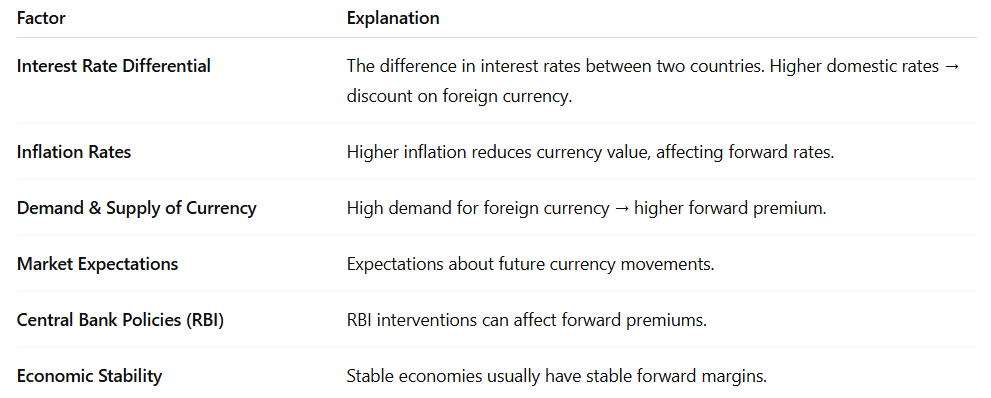

Factors Determining Forward Margin

Summary Table

Merchant Rates

Merchant rates are the foreign exchange rates quoted by banks to their customers (merchants/importers/exporters) for buying or selling foreign currencies.

Basis of Merchant Rates

Merchant rates are based on:

Types of Buying and Selling Rates

Banks quote different rates for buying and selling foreign exchange, depending on the purpose and timing.

Types of Buying Rates

Types of Selling Rates

Ready Rates Based on Cross Rates

Cross Rates: A cross rate is the exchange rate between two currencies derived from a third common currency (usually USD).

Example of Cross Rate: You want INR/GBP rate, but only INR/USD and USD/GBP are available.

Ready Rates: Ready (Spot) Rates for currencies not directly quoted (e.g., INR/EUR) are calculated using cross rates.

Example

- INR/USD = ₹82

- USD/GBP = 0.75

- Then, INR/GBP = ₹82 / 0.75 ≈ ₹109.33

Summary Table

Forward Exchange Contract

A Forward Exchange Contract is an agreement between a bank and a customer to buy or sell foreign currency at a predetermined rate on a future date.

It protects against foreign exchange risk due to currency rate fluctuations.

Types of Forward Contracts

Difference Between Fixed and Option Forward Contracts

Calculation of Fixed and Option Forward Rates

Formula:

- Add Forward Margin if currency is at a premium.

- Subtract Forward Margin if currency is at a discount.

Option Forward Rate Calculation: For option contracts, banks use the forward margin for the last date of the option period.

- Spot rate = ₹82/USD

- 1-month premium = ₹0.50

- 2-month premium = ₹0.80

- → 1–2 month option forward rate = ₹82 + ₹0.80 = ₹82.80/USD

Inter-Bank Deals

- Managing liquidity

- Covering customer positions

- Hedging risks

Types

Execution of Forward Contracts

Steps

- Agreement Signed: Bank and customer sign a forward contract specifying rate, amount, date.

- Booking the Deal: Bank books the deal in its forex system and commits the rate.

- Covering Position: Bank may cover the contract through inter-bank forward deals.

Settlement on Due Date

- Customer delivers the agreed amount.

- Bank delivers currency as per contract rate.

Cancellation and Extension

- If the customer fails to fulfill the contract:

- Bank cancels the contract and recovers loss/gives profit.

- Contract can be extended with revised forward rate.