Tax Planning & Management

TAX PLANNING & MANAGEMENT

Tax Planning

It is the legal method of reducing tax liability by using the provisions of law to your advantage.

Features

- Completely legal

- Based on available exemptions, deductions, rebates (like 80C, 80D)

- Helps in saving taxes + achieving financial goals

Example:

- Investing ₹1.5 lakh in PPF under Section 80C

- Taking home loan to claim interest deduction

Tax Management

It refers to the efficient handling of tax affairs, including timely filing of returns, payment of taxes, and compliance with tax laws.

Activities include:

- Keeping proper records and books

- Calculating tax liability correctly

- Filing returns before due date

- Deducting and depositing TDS

Objective: To avoid penalties and interest due to non-compliance.

Tax Avoidance

Definition: Using loopholes in tax laws to reduce tax liability without violating the law, but against the spirit of the law.

Features

- Technically legal, but ethically questionable

- Exploits gaps in the tax system

- Often challenged by tax authorities

Example - Shifting income to family members in lower tax brackets to save tax

Tax Evasion

Definition: Illegal method of reducing tax liability by hiding income, falsifying accounts, or not disclosing full income.

Features

- Criminal offence

- Results in penalty, interest, and even imprisonment

- Violates provisions of law

Example

- Not reporting cash income

- Claiming fake deductions

INCOME TAX AUTHORITIES (Section 116 to 120 of Income Tax Act)

Appointment

Income Tax Authorities are appointed by the Central Government under the Income Tax Act.

They include:

| Category | Examples |

|---|---|

| Higher Authorities | CBDT, Principal Chief Commissioner |

| Assessing Authorities | Assessing Officer, Income Tax Officer |

| Appellate Authorities | Commissioner (Appeals), ITAT |

Jurisdiction

Meaning: Jurisdiction means the area, type of assessee, or nature of income over which an authority can operate.

Jurisdiction is decided by

- CBDT (Central Board of Direct Taxes)

- Based on geography, income slab, or type of assessee (individual, company, etc.)

Example:

-

A salaried person in Lucknow may be assigned to Ward 2(1), Lucknow

Powers of Income Tax Authorities

| Authority | Powers |

|---|---|

| All IT Authorities | Conduct surveys, inspections, issue notices |

| Assessing Officer | Assess income, raise tax demand, conduct scrutiny |

| Commissioner (Appeals) | Handle appeals from taxpayers |

| ITAT (Income Tax Appellate Tribunal) | Hear second-level appeals |

| CBDT | Policy-making, issuing circulars, instructions |

| Powers of Civil Court | In some cases (e.g., calling witnesses, enforcing attendance) |

Functions of Income Tax Authorities

| Function | Description |

|---|---|

| Assessment | Examining returns, issuing tax demand notices |

| Collection and Recovery | Ensuring taxes are paid on time |

| TDS Monitoring | Ensuring tax is deducted and deposited by deductors (employers, banks, etc.) |

| Appeals & Revisions | Hearing appeals filed by taxpayers |

| Survey, Search & Seizure | Investigating hidden or black income |

| Guidance and Clarifications | CBDT issues circulars and notifications for clarification |

| Enforcement | Taking legal actions against defaulters and tax evaders |

Quick Comparison: Tax Planning vs Avoidance vs Evasion

| Basis | Tax Planning | Tax Avoidance | Tax Evasion |

|---|---|---|---|

| Legal Status | Legal | Legal (not ethical) | Illegal |

| Intention | To save tax legally | To exploit loopholes | To avoid tax unlawfully |

| Penalty | No | Possibly | Yes |

| Example | 80C investments | Income splitting | Not declaring income |

Collection and Recovery of Tax

The Income Tax Department ensures that taxes are collected efficiently and if not paid voluntarily, are recovered forcibly.

Modes of Collection:

| Mode | Explanation |

|---|---|

| Advance Tax | Paid during the year based on estimated income (in 4 installments). |

| TDS (Tax Deducted at Source) | Tax deducted at the time of earning income (e.g. salary, rent, interest). |

| Self-Assessment Tax (Sec 140A) | Paid while filing income tax return if tax is still due. |

| Regular Assessment Tax | Tax demand raised after assessment by the AO (Assessing Officer). |

Modes of Recovery (Sec 222–232):

| Mode | Description |

|---|---|

| Notice of demand (Sec 156) | Issued when tax is due – must be paid within 30 days. |

| Attachment of property | AO can seize movable/immovable assets if tax not paid. |

| Recovery from employer/debtor | AO can order your employer or debtor to pay your tax dues directly. |

| Arrest and Detention | In rare cases, defaulters can be arrested (Sec 276C). |

Refund of Tax (Sec 237–245)

When a person pays more tax than required, they are entitled to get a refund.

Key Points:

| Provision | Description |

|---|---|

| Refund Claim | Can be claimed while filing the ITR or by filing a revised return. |

| Interest on Refund (Sec 244A) | If refund is delayed beyond 3 months from the due date, interest @ 0.5% per month is paid. |

| Adjustment of Refund (Sec 245) | Tax Department can adjust your refund against any pending demand. |

Offences under the Income Tax Act

These are actions that violate tax laws and are punishable.

| Offence | Section | Example |

|---|---|---|

| Failure to file return | Sec 276CC | Not filing ITR when income > exemption limit |

| Failure to pay tax | Sec 276B | Not depositing TDS deducted |

| False statement in verification | Sec 277 | Lying in the return or during assessment |

| Abetment of false return | Sec 278 | Helping someone file a false return |

| Willful attempt to evade tax | Sec 276C | Hiding income or manipulating accounts |

Penalties under the Income Tax Act

Penalties are monetary fines imposed for violating provisions.

| Violation | Section | Penalty |

|---|---|---|

| Failure to file return on time | Sec 234F | ₹5,000 (₹1,000 if income < ₹5 lakh) |

| Under-reporting of income | Sec 270A | 50% of tax on under-reported income |

| Misreporting of income | Sec 270A | 200% of tax on misreported income |

| Failure to maintain books/documents | Sec 271A | ₹25,000 |

| Failure to get accounts audited | Sec 271B | ₹1,50,000 or 0.5% of turnover (whichever is less) |

| Failure to deduct/deposit TDS | Sec 271C | Equal to the amount of TDS not deducted or deposited |

Prosecution under the Income Tax Act

Prosecution means criminal legal proceedings which may result in imprisonment or fine or both.

| Offence | Section | Punishment (Imprisonment) |

|---|---|---|

| Willful tax evasion > ₹25 lakh | Sec 276C | 6 months to 7 years + fine |

| Failure to file return | Sec 276CC | 3 months to 2 years + fine |

| Not depositing TDS | Sec 276B | 3 months to 7 years + fine |

| False statement | Sec 277 | Up to 7 years + fine (depending on amount involved) |

Conclusion

| Concept | Legal? | Penalty? | Prosecution Possible? |

|---|---|---|---|

| Tax Planning | ✅ Yes | ❌ No | ❌ No |

| Tax Avoidance | ✅ Technically | ⚠️ Maybe | ❌ No |

| Tax Evasion | ❌ Illegal | ✅ Yes | ✅ Yes |

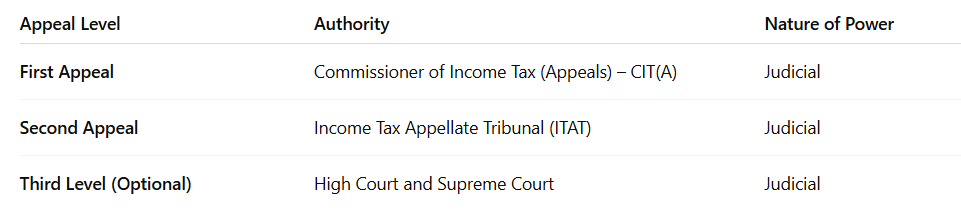

Appeals and Revisions

Appeals (Sec 246–264)

Time Limit

- Appeal to CIT(A) – within 30 days of order

- Appeal to ITAT – within 60 day

Revisions (Sec 263 & 264)

Revision is done by a higher authority to correct errors in an order.

| Type | By Whom | When Used |

|---|---|---|

| Sec 263 – Revision in favour of Revenue | CIT | If AO’s order is erroneous & prejudicial to revenue |

| Sec 264 – Revision in favour of Assessee | CIT | If assessee is unhappy and wants relief |

Advance Tax (Pay-as-you-earn)

It is the tax paid in installments during the financial year, instead of paying it all at once at the end.

Who should pay?

- Individuals with tax liability above ₹10,000/year

- Salaried people (if TDS not enough), freelancers, businesses, companies, etc.

Due Dates for Individuals (Non-company):

| Installment | Due Date | % of Total Tax Payable |

|---|---|---|

| 1st | 15th June | 15% |

| 2nd | 15th September | 45% |

| 3rd | 15th December | 75% |

| 4th | 15th March | 100% |

TDS – Tax Deducted at Source

TDS is a method of collecting tax at the source of income. The payer deducts tax before paying the receiver.

Common Examples

| Nature of Payment | TDS Rate | Section |

|---|---|---|

| Salary | As per slab | Sec 192 |

| Interest on FD | 10% | Sec 194A |

| Rent > ₹50,000/month | 5% | Sec 194IB |

| Contract payments | 1%-2% | Sec 194C |

| Professional Fees | 10% | Sec 194J |

- TDS deducted is deposited to the government.

- TDS certificates (Form 16/16A) are issued to deductees.

Advance Rulings (Sec 245N–245V)

It is a written decision by tax authorities on a question of law or fact related to future transactions.

Who can apply?

- Non-residents, and now residents (esp. in complex international tax matters)

- Businesses entering cross-border deals

Benefits

- Tax certainty

- Helps in international tax planning

- Binding decision

Avoidance of Double Taxation Agreements (DTAA)

It is a tax treaty between two countries to avoid double taxation of the same income in both countries.

Why needed?

- If a person earns income in two countries, both might try to tax it.

- DTAA helps the person pay tax only once or get relief.

Methods to Avoid Double Taxation:

| Method | Description |

|---|---|

| Exemption Method | Income is taxed in only one of the two countries |

| Tax Credit Method | Income is taxed in both, but tax paid abroad is allowed as credit in home country |

Example:

If an Indian resident earns interest in the USA:

-

DTAA ensures India allows tax credit for tax already paid in the US.

Summary Table

| Topic | Key Idea |

|---|---|

| Appeals & Revisions | Legal remedy against wrong assessment orders |

| Advance Tax | Pay tax in installments during the year |

| TDS | Tax deducted at the time of income payment |

| Advance Ruling | Binding decision before a transaction for tax certainty |

| DTAA | Avoids taxation of same income in both source and resident countries |