Financial Credit

Financial Credit

Financial Credit refers to the ability of a borrower (individual, business, or government) to obtain goods, services, or money in the present with the promise to pay back in the future. It is essentially a loan or financial trust extended by lenders such as banks, NBFCs, or other financial institutions. Example: Bank gives a loan to a businessman to start a company. This loan is financial credit.

Objectives of Financial Credit

The main objectives of providing financial credit are:

Credit Risk

Credit Risk refers to the possibility that the borrower may fail to repay the loan (principal + interest) on time or in full.

Types of Credit Risk

Impact of Credit Risk

- Loss of money for lender.

- Increase in Non-Performing Assets (NPA).

- Weak financial health of banks.

Credit Analysis

Credit Analysis is the process used by lenders to assess the creditworthiness of a borrower before giving a loan.

Key Steps in Credit Analysis

5 Cs of Credit Analysis

- Character – Borrower’s trustworthiness.

- Capacity – Ability to repay.

- Capital – Financial strength.

- Collateral – Security against loan.

- Conditions – Terms of loan and economic environment.

Summary Table

Seven C’s of Credit (Extended version of 5 C’s)

The Seven C’s of Credit help lenders assess the creditworthiness of a borrower more thoroughly.

Credit Analysis Process

This process is used to evaluate if a borrower qualifies for a loan.

Credit Process

This is the overall flow of steps from giving credit to recovering it.

Documentation in Credit Process

Documentation ensures that the loan is legally enforceable and reduces credit risk.Summary Table

Loan Pricing and Profitability Analysis

A. Loan Pricing

Loan Pricing refers to deciding the interest rate and charges on loans given by banks or financial institutions to ensure profitability and cover risk.

Factors Affecting Loan Pricing

Loan Pricing Formula (Basic)

Loan Rate = Cost of Funds + Operating Costs + Risk Premium + Profit Margin

B. Profitability Analysis

This refers to measuring whether a loan or credit portfolio generates sufficient income for the bank or lender.

Regulations Related to Loans

Lending is governed by banking laws and regulations to ensure safety, fairness, and transparency.

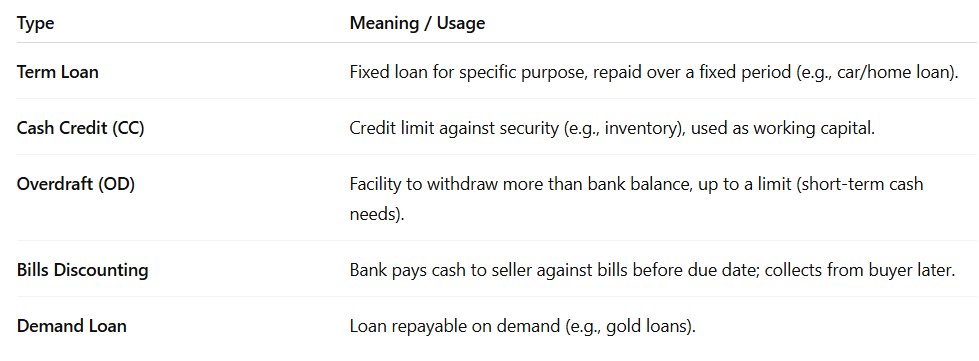

Types of Credit Facilities

Credit facilities are various loan products or lines of credit extended by banks to meet different needs.

A. Fund-Based Credit Facilities

B. Non-Fund-Based Credit Facilities

Summary Table

Types of Credit Facilities

1. Cash Credit (CC)

Cash Credit is a short-term loan facility provided to businesses for working capital needs. A limit is set based on borrower’s security (like stock or receivables).

Key Features

- Interest is charged only on the amount utilized.

- Flexible withdrawal within the sanctioned limit.

- Renewed annually.

Example: A shopkeeper gets ₹5 lakh cash credit; uses ₹2 lakh, pays interest on ₹2 lakh only.

2. Overdraft (OD)

Overdraft allows a customer to withdraw more money than their bank balance, up to a limit.

Key Features

- Offered to both individuals and businesses.

- Interest charged on overdrawn amount only.

- Usually linked to current or savings account.

Example: You have ₹10,000 in your account but withdraw ₹15,000; ₹5,000 is OD and interest applies.

3. Demand Loan

Loan that must be repaid on demand by the lender. No fixed repayment period.

Key Features

- Often secured (e.g., gold loan, mortgage).

- Interest charged on the entire loan amount from disbursal date.

- Suitable for short-term urgent needs.

Example: Gold loan is a type of demand loan; bank can demand repayment anytime.

4. Bill Finance – Drawee Bill Scheme

Under the Drawee Bill Scheme, the drawee (buyer) arranges for the acceptance of the bill of exchange and discounts it with the bank to make payment to the seller.

Key Features

- Used in trade transactions (buyer-seller).

- Buyer gets credit from bank, seller gets payment on time.

- Bank collects from buyer on due date.

Example: Buyer accepts bill, bank pays seller, collects money from buyer later.

5. Bill Discounting

Bill Discounting is when a seller gets immediate cash from the bank by selling a bill of exchange before its maturity.

Key Features

- Bank deducts a discount (interest) and pays the balance.

- On due date, bank collects full amount from buyer.

- Helps businesses improve cash flow.

Example: A business sells goods on credit for ₹1 lakh (due in 90 days), discounts bill with bank for ₹98,000, bank collects ₹1 lakh later.

Comparison Table

Cash Delivery

Cash Delivery refers to the method by which loan funds or credit facility amounts are given (disbursed) to the borrower by the bank or financial institution. The delivery can be in cash, account transfer, or payment to a third party, depending on the type of facility and agreement.