Capital Market & Asset Pricing

Capital Market & Asset Pricing

Technical Analysis is the study of historical price and volume to predict future price movements in the financial markets. It is based on the belief that "price reflects all information".

Dow Theory

Developed by Charles Dow, it is the foundation of modern technical analysis.

Six Basic Principles of Dow Theory

Support and Resistance Levels

Support Level

"Floor" of the market

Resistance Level

"Ceiling" of the market

| Term | Meaning |

|---|---|

| Support | Buying zone, price bounces back upward |

| Resistance | Selling zone, price falls from the top |

Traders use these levels to enter or exit trades.

Types of Charts & Their Interpretations

A. Line Chart

B. Bar Chart

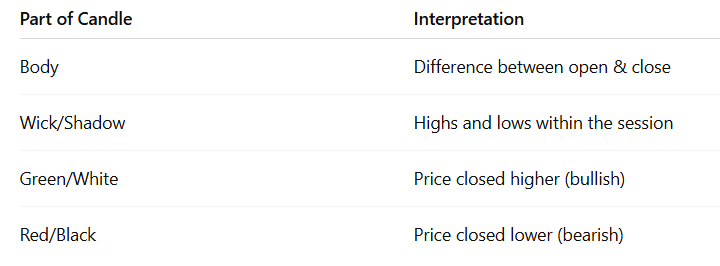

C. Candlestick Chart

Capital Market & Technical Analysis

Trend Line

Types of Trend Lines

Gap Theory (Price Gaps)

Types of Gaps

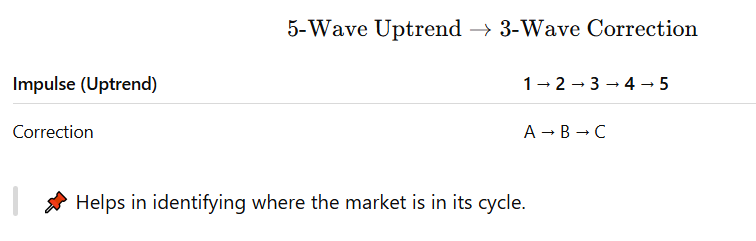

Wave Theory (Elliott Wave Theory)

Wave Patterns

- Impulse Waves (5 waves): Direction of the main trend

- Corrective Waves (3 waves): Move against the trend

Pattern:

Relative Strength Analysis (RSI)

RSI Scale: 0 to 100

Nature of Stock Markets & EMH (Efficient Market Hypothesis)

What is a Stock Market?

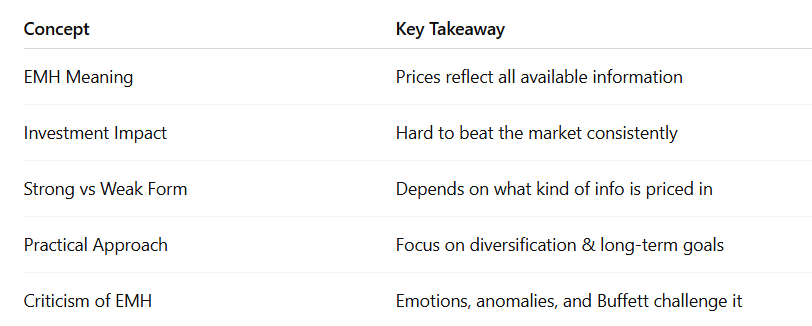

What is Efficient Market Hypothesis (EMH)?

In simple words:

- You can’t consistently beat the market because whatever you know, the market already knows.

- Prices are fair most of the time.

Three Forms of EMH

Implications of EMH on Investment Decisions:

Real-Life Example

- In an efficient market, the stock price immediately adjusts to the news.

- So, by the time you decide to buy the stock tomorrow, it's already too late to profit.

What Should Investors Do (MBA Perspective):

Efficient Market Hypothesis is not a trading strategy but a philosophy. It encourages passive investing, staying rational, and believing that the market is usually right — though not always perfect.

Capital Market Theorem, CAPM & APT

The Capital Market Theorem is based on Modern Portfolio Theory and leads to the Capital Market Line (CML).

📌 What is it?

Imagine you're choosing from thousands of investments (stocks, bonds, etc.). The theorem says:

"There is one best line (the CML) that shows the highest return for every level of risk."

CML = Risk-free return + (Market risk premium × Portfolio risk)

Where:

-

: Portfolio return

-

: Risk-free rate (e.g., government bond)

-

: Market return

-

: Portfolio risk (standard deviation)

-

: Market risk

The Capital Market Line is used to build an efficient portfolio — one that gives maximum return for a given level of risk.

CAPM – Capital Asset Pricing Model

The CAPM is one of the most famous models in finance. It helps us calculate the expected return of a stock, based on how risky it is compared to the market.

📌 What is it?

"The more risky an investment is, the more return investors expect."

📊 CAPM Formula:

Where:

-

: Expected return of stock

-

: Risk-free rate

-

: Market return

-

: Beta of the stock (how volatile the stock is compared to the market)

🧠 In simple terms:

-

Suppose Bank FD gives you 5% (risk-free).

-

You want to invest in a risky stock — CAPM helps you find out how much extra return (risk premium) you should get.

-

The more volatile the stock (higher beta), the more return you should expect.

📌 Example:

-

, ,

So, if you're taking more risk, you deserve more return!

APT – Arbitrage Pricing Theory

APT is like a more flexible version of CAPM.

📌 What is it?

APT says that a stock’s return is influenced by multiple factors, not just the market.

🧠 In Simple Language:

- CAPM says: 🧍“Stock depends on one thing — the market.”

- APT says: 👥“Stock depends on many things — interest rates, inflation, oil prices, GDP, etc.”

📊 APT Formula:

Where:

-

: Expected return

-

: Risk-free rate

-

: Risk factors (e.g. inflation, GDP)

-

: Sensitivity to each factor

Example:

Let’s say the price of a stock depends on:

-

Inflation

-

Interest rate

-

Industrial growth

APT allows you to include all 3 in one model to calculate the return.

Comparison Table: CAPM vs APT

| Feature | CAPM | APT |

|---|---|---|

| Risk Factors | Only 1 (Market) | Multiple (macro factors) |

| Simplicity | Very simple & widely used | More flexible but complex |

| Practical Use | Good for general return estimate | Good for advanced risk modeling |

| Formula | Single beta | Multiple betas |

| Concept | What It Tells You | Main Use |

|---|---|---|

| Capital Market Line | Best return per unit of total risk | Portfolio construction |

| CAPM | Return expected from a risky asset | Stock valuation, pricing |

| APT | Return from multiple risk factors | Detailed investment analysis |