Unit 4: Exchange Dealings

Dealing Position

It refers to the current position of a forex dealer (bank or trader) after conducting buying and selling activities of foreign currencies.

Purpose: To track how much foreign currency a dealer owes or holds, i.e., their net position.

Types

- Long Position: When a dealer has bought more foreign currency than sold. (Expecting the value to rise.)

- Short Position: When a dealer has sold more foreign currency than bought. (Expecting the value to fall.)

Exchange Position

The net balance of foreign currencies held by a bank or dealer at a given point.

Formula

Exchange Position=Purchases (Receivables)−Sales (Payables)

Types

- Overbought Position: Purchases > Sales (Excess foreign currency).

- Oversold Position: Sales > Purchases (Deficit in foreign currency).

Management: Banks maintain this position within limits set by central banks to control foreign exchange risk.

Cash Position

The actual availability of foreign currency in cash or demand accounts at a particular time.

Focus: This tracks the liquidity — whether the dealer has enough cash to settle transactions.

Example: If a customer comes to withdraw foreign currency, the cash position ensures the bank can fulfill this need immediately.

Difference from Exchange Position: Exchange position includes forward contracts and deals yet to settle, while cash position is about available funds now.

Comparison Table

Summary

- Dealing Position = How much the dealer is exposed to market changes.

- Exchange Position = Net buying/selling position.

- Cash Position = Available foreign currency for immediate use.

Mirror Account

Purpose

- To ensure accuracy and reconciliation between two accounts (home and foreign branch).

- Helps track foreign currency inflows and outflows.

Example: Branch A (India) and Branch B (USA) maintain mirror accounts in each other’s books to record reciprocal entries.

Value Date

Importance

- Ensures proper interest calculation.

- Prevents disputes over payment timing.

Exchange Profit and Loss

When It Happens

- Buying at one rate, selling at another.

- Revaluation of foreign currency holdings.

Types

- Realized Profit/Loss: From actual completed transactions.

- Unrealized Profit/Loss: From revaluation of open positions (not yet settled).

R Returns (RBI Returns in India)

Purpose

- To monitor and regulate foreign exchange transactions.

- Ensure compliance with RBI guidelines.

Types

- R-Return (Daily/Monthly): Summary of forex deals, positions, and exposures.

- Other Returns: Like XOS, BEF, ENC, for tracking exports, import payments, etc.

Contents

- Bank’s foreign currency assets and liabilities.

- Exchange position and profit/loss data.

Summary Table

Risk in Forex Dealing

Forex (Foreign Exchange) dealing involves buying/selling foreign currencies, which exposes dealers to various types of risks

Measure of Value at Risk (VaR)

Key Components

Example: A 1-day VaR of ₹10 lakh at 99% confidence means: There’s a 1% chance that the loss will exceed ₹10 lakh in one day.

Methods to Calculate VaR

Foreign Exchange Markets

Key Features

Summary Table

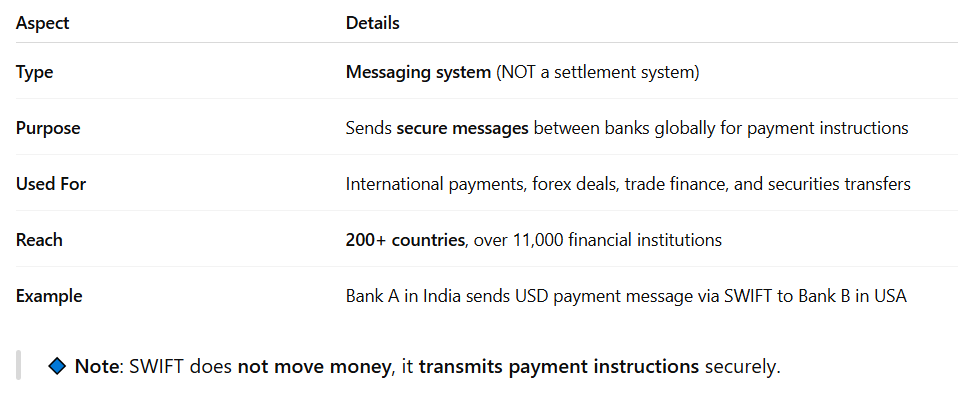

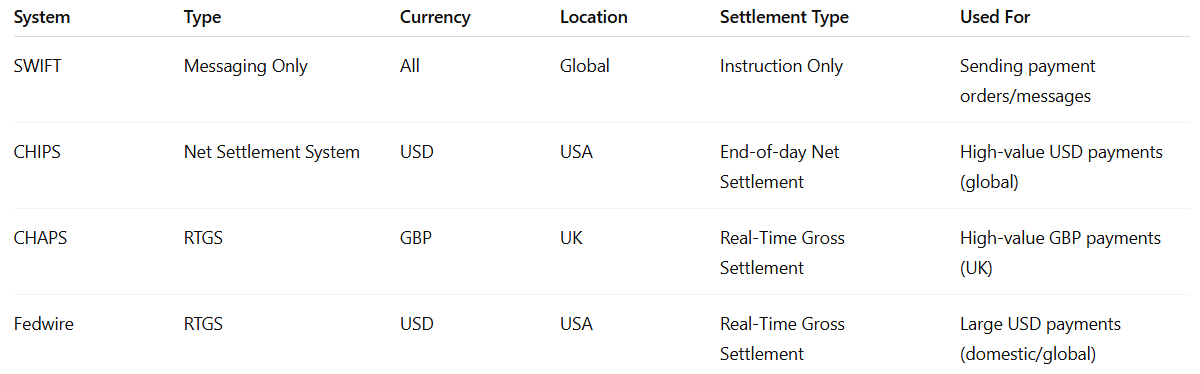

SWIFT (Society for Worldwide Interbank Financial Telecommunication)

CHIPS (Clearing House Interbank Payments System) – USA

CHAPS (Clearing House Automated Payment System) – UK

Fedwire (Federal Reserve Wire Network) – USA

Summary

- SWIFT: Secure message system → no funds move.

- CHIPS: Large USD payments → settled in net.

- CHAPS: Instant GBP payments → real-time gross.

- Fedwire: Instant USD payments → real-time gross.